What Impacts Will the Russia-Ukraine Conflict Have on the Global Low-carbon Energy Transition Process?

As the world’s largest exporter of natural gas and second largest exporter of oil, Russia plays an important role in the global energy supply system. Since February 2022, the conflict between Russia and Ukraine has gradually escalated and deepened the concerns the world about energy security. Although the actual supply and demand of oil and gas have not been significantly affected for the time being, the fear of oil supply disruption in the market has spurred higher international energy prices. The volatile oil and gas prices have strengthened the determination of the whole world, especially EU countries, to accelerate energy transition and pursue energy independence. This has brought opportunities as well as challenges to the global low-carbon energy transition process and the development of new energy industry. This paper analysis the Russia-Ukraine conflict’s impact on the global energy landscape and sort out the countermeasures of world’s major economies against this background. On these bases, this paper points out the opportunities and challenges faced by the global low-carbon energy transition process and the development of new energy industry.

I. What is the impact of the Russia-Ukraine conflict on the global energy landscape?

Russia plays a decisive role in the global oil and gas supply chain. As the world’s largest exporter of natural gas and second largest exporter of crude oil, Russia exported 230 million tons of oil and 252 billion cubic meters (bcm) of natural gas in 2021, accounting for 11% and 16% of the world’s total export volume respectively. The crude oil from Russia mostly flowed to European countries (57%), especially Germany, the Netherlands and Poland4. China was the largest importer of Russian crude oil and condensate, accounting for 31%4. 89% of Russian natural gas exports went to Europe, mainly to Germany, Italy and France.

On the demand side, Europe’s dependence on imports of crude oil and natural gas in 2020 was about 95% and 83% respectively, with 27% of oil and 45% of natural gas from Russia. Russia accounts for 15% of crude oil, 8% of liquefied natural gas (LNG) and 9% of piped gas among China’s imports.

Ukraine is an important energy transportation route for Europe. 40 billion out of the 155 bcm of pipeline natural gas imported from Russia in 2021 went through Ukraine. As of the end of January 2022, the total gas reserves of Europe hit a record low of 42 bcm, accounting for only 37.5% of the stock. Any disruption in the flow of Russian gas to Europe through Ukraine would affect trading prices and LNG import demand.

When the situation remains unclear in the battlefield, Europe and the U.S. have launched several rounds of financial and energy-related sanctions against Russia. However, the current sanctions appear severe but have not impacted so much for oil and gas trade. While U.S. President Joe Biden signed an executive order banning U.S. energy imports from Russia, the United Kingdom also announced it would stop importing Russian oil and related petroleum products by the end of 2022. But the consumption of Russian oil in the U.S. and the UK accounted for less than 10% of two countries oil and gas consumption, so the ban will not have a big impact on either country. In the contrary, responding to Biden’s order, U.S. companies stepped up oil imports ahead of April 22 when the ban will come into force (Between March 19 and March 25, U.S. oil imports from Russia increased 43% from the previous week). In addition, the EU currently excludes Russia’s fossil energy trade from sanctions because of the high dependence from Russia in oil and gas trade.

The sanctions have so far had little impact on global oil and gas trade, but geopolitical risk exacerbated by the military conflict as well as market concerns about oil and gas supply lead to oil prices that have risen significantly under the quantitative easing monetary policy and the recovery of post-epidemic demand since the outbreak of COVID to further surge in half a month from more than $90 to $130 a barrel. Oil prices decreased on March 10 as the United Arab Emirates announced support for an extra production boost, relieving some supply concerns in the market. On March 11, Brent and WTI crude futures closed at $112.67 and $109.33 a barrel respectively. From March 18, 2022, China’s National Development and Reform Commission (NDRC) had raised the prices of refined oil for the sixth time since the end of December 2021. The prices of premium gasoline have ushered in the “ ¥9 era” in most parts of China.

While global oil prices are soaring, natural gas prices have been hitting record highs. Dutch front-month natural gas futures, the benchmark for European gas prices, are currently trading as high as 200 euros per megawatt hour. Gas price volatility, along with a shortage of alternative energy sources, has also pushed up power prices in Europe. As of mid-March 2022, the average price of the power spot market in major Western European countries, including Germany, France and the UK, had been 8 to 10 times that of the same period last year. The European Central Bank has predicted that higher energy costs due to the Ukraine crisis will reduce European GDP growth by 0.5 percentage points in 2022. Although the Russia-Ukraine conflict is far from Asia, global energy markets are connected. China has witnessed the LNG spot market price, the long-term agreement price and the transaction price of extra-gas auction rising all the way (the long-term agreement price is generally linked with oil prices or trading hub prices). The fuel cost of gas-generated electricity has been as high as ¥1-2/KWh (the coal-fired electricity benchmark of on-grid price in provinces is generally ¥0.3/KWh to ¥0.45/KWh). Gas power plants are no longer economical at all under the current price level.

In addition, the bans of the US and the UK have a dramatic demonstration effect. There have been a number of companies withdrawing investments from Russia or pressing the “pause button” on accelerating their business in Russia. BP group announced on February 27 that it would sell 19.75% of its stake in Rosneft and estimated that BP could incur a non-cash loss of up to $25 billion as a result of the exit. Exxonmobil announced on March 1 that it would exit its oil and gas business valued at more than $4 billion from Russia and halt new investments. Apple Inc. said it would pause all product sales in Russia and limit payment features. Norway’s biggest energy company Equinor ASA also announced that it would exit a $1.2 billion joint venture from Russia.

Whether energy prices will continue to rise and trigger a global energy crisis has to be judged with caution. From the development of the world petroleum industry in the past 150 years, the fluctuation of crude oil prices is often influenced by supply and demand. In the 1970s, for example, when the Middle East was in turmoil, oil prices soared to $110 in 1980 when the Iran-Iraq war broke out and then fell to about $20 in 1999 as the crude output rose thanks to the tension relieved in the Middle East. The 2008 financial crisis led to rapidly deteriorating world economy and demand for crude oil, and oil prices fell to the new low from 2004. The current conflict between Russia and Ukraine has not affected the output, transport and supply of oil producing countries. The current high level of energy prices is driven more by market expectations. The future direction of oil prices may be determined by the controllability of the situation between Russia and Ukraine. If it continues to ferment, oil prices may continue to surge whereas if the conflict abates, oil prices are likely to reach the ceiling.

II. What are the countermeasures of major economies?

EU

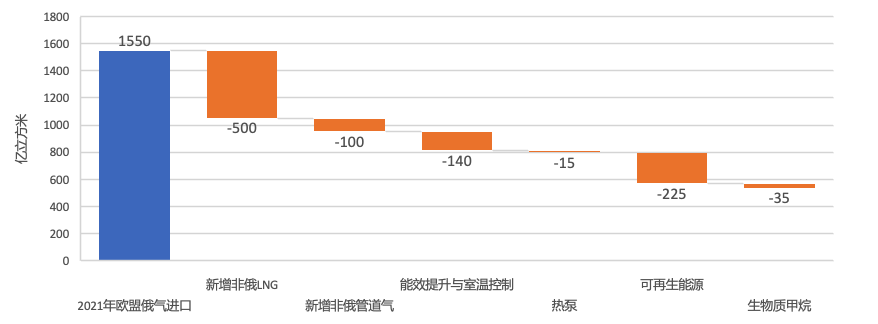

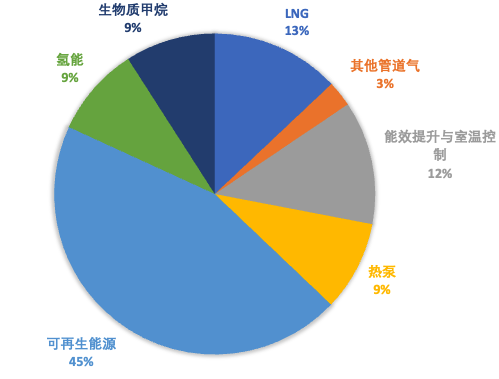

Europe is at the forefront of the conflict between Russia and Ukraine, and Russia is the most important exporter of European energy. The rising commodity prices and sanctions imposed by EU countries on Russia have put Europe’s energy supply and prices under the most severe pressure ever. To ensure energy independence, the European Commission launched the Joint European Action for More Affordable, Secure and Sustainable Energy (REPowerEU) on March 8, which, based on ‘Fit For 55’, proposes to reduce EU demand for Russian gas by two-thirds before the end of 2022 and phase out its dependence on fossil fuels from Russia well before 2030. Measures are mostly taken to diversify gas supplies in the near term (accounting for more than half of the options), and speed up the roll-out of renewable gases and boost energy efficiency in the medium and long term. Leaders of the 27 EU member states agreed on the action plan on March 11th, and the European Commission will set out further rules for implementation.

Fig.2 EU’s Alternative to Russian Gas before the end of 2022

Fig.3 EU’s Alternative to Russian Gas before 2030

Data sources: Communication from the EU Commission: REPowerEU: Joint European Action for more affordable, secure and sustainable energy

Whether this action plan can be implemented effectively is subject to infrastructure, supply, cost and other factors. And it is more difficult to implement short-term plans on gas supply diversification than the long-term goals. Firstly, the EU expects to import 50 bcm of LNG a year, with more than 40 new LNG carriers a month needed to make up the shortfall. It will also require the infrastructure of LNG terminals in Europe to keep up the pace. In January 2022, Europe imported more than 16 bcm of LNG, a record high volume of imports that has made almost all existing LNG terminals in Europe operating at full capacity. Secondly, the U.S. and its gas-producing allies cannot completely replace Russia in terms of gas supply for the time being. In 2021, the U.S., Qatar and Russia accounted for almost 70% of Europe’s total LNG imports. Qatar’s LNG facilities are now running at full capacity, with little room for production increase in the short term, and much of its gas supply has been locked up in long-term agreements with Asian buyers, making it difficult to meet new demand in Europe. On March 25, the EU reached a blockbuster gas deal with the U.S., in which the EU would purchase at least 15 bcm of additional LNG from the U.S. this year. However, it is difficult for the U.S. to completely ease Europe’s gas shortage, because although it can increase LNG exports to Europe through redistribution in the short term, e.g. temporary allocation of LNG from Asia to Europe, it is hard to see a significant increase in exports to Europe in the medium to long term (LNG terminals in the U.S. are already operating at full capacity, and new facilities will take years to be built). Thirdly, if Europe wants to import more LNG from non-Russian countries this year, it will make the already tight global LNG market even worse, and incur higher import costs. Europe plans to increase stocks to 80% of available reserves by next winter, meaning nearly 800TWh of new gas, which would cost about €160 billion at current TTF price €200 per MWh.

U.S.

Russian oil accounted for only about 3% of all crude oil imports to the U.S. last year, and the ban on Russian energy imports will have little impact on the U.S. domestic energy supply system. The challenge is how to deal with cost-push inflation caused by high oil prices. Biden delivered his first State of the Union address on March 2, focusing on how to cope with the Ukraine issue externally and the inflation internally. U.S. CPI hit 7.9% in February 2022 (the largest increase in the past 40 years), and the average price of regular gasoline soared to $4.58/gallon as of April 4, breaking the record set during the 2008 financial crisis. On March 31, U.S. President Joe Biden announced that 1 million barrels of oil will be released per day for the next six months from strategic reserve in an effort to tame the elevated gas prices and inflation. With the mid-term election looming in November, the Democrats’ congressional gains could be at risk if inflation has not been eased significantly by the end of the summer.

China

After the outbreak of the Russia-Ukraine conflict, the implementation and future plan of China-Russia natural gas trade remain unchanged for the time being. There are two natural gas supply channels between China and Russia: one is the China-Russia east-route natural gas pipeline with an actual capacity of about 10 bcm in 2021 and the supply volume through it is expected to reach the designed pipeline capacity of 38 bcm by 2024; the other one is Russia’s large LNG project in the Arctic, which will export about 4 million tons (5.6 bcm) of LNG to China every year. It seems that China has market space to increase imports of Russian piped gas, but based on the strategy of energy supply security, China will not rely too much on a single source. In addition, the cross-border natural gas and LNG industry is a systematic project integrating “gas source, channel and consumer market”, which takes about 5 to 10 years to be built. So it is difficult for China to completely replace the EU as a new buyer of Russian gas in the short term.

III. Will the global energy green and low-carbon transition go backwards?

The answer is no. On the contrary, after the global energy crisis, many countries have realized the importance of enhancing energy independence. Under the goal of carbon neutrality, they need to reduce their dependence on fossil fuel imports through clean energy. The long-term trend towards a low-carbon energy transition in Europe remains clear, and many of the targets in the REPowerEU are not provoked by the Russia-Ukraine conflict, but are aimed at building on the European Green Deal previously proposed by the European Commission. All EU member states, represented by France and Germany particularly, have chosen renewable energy or nuclear energy as an important solution to tackle energy security France will build six new nuclear power units from 2028, and eight more units before 2040. By 2050, 25 million kilowatts of new nuclear power will be installed, and the existing units will be extended to operate. The share of nuclear power in France’s electricity generation mix would fall from 67% in 2020 to 50% in 2050.. France will further increase investment in new energy, and uplift the installed solar power capacity by nearly 10 times by 2050, with a total installed capacity of 100GW and 40GW of offshore wind power. Germany announced at the end of February that its 2030 coal withdrawal plan would remain unchanged, and coal plants may be open longer in order to ensure energy security. There is no need for additional coal plants as the existing ones are still operating at capacity but only decommissioning the coal plants will be suspended while backup coal plants are likely to operate more frequently. Although in the short term, the closure of some coal plants is delayed, but in the long term, coal as a transitional means has gained time for new energy expansion. Germany is set to speed up parliamentary passage of an amendment to its Renewable Energy Law that aims to increase wind and solar power to 80% of electricity generation by 2030. In the new climate-oriented government, both the German Foreign Minister and the Federal Minister for Economic Affairs and Climate Action have the Green Party background. There is a strong political will to promote Germany’s energy independence targeting at comprehensive integration of security, green and pluralism.

New energy will be a key contributor to energy increase in the future, on which, not only Europe but the world has reached a consensus. The U.S. announced that the newly installed Solar power will account for about half of all new installations in 2022. With a target of achieving 80% clean electricity by 2030, its cumulative installed renewable energy capacity will rise to 885 gigawatts. The Chinese government has also set the goal of increasing the share of non-fossil energy in primary energy consumption to 25% by 2030, and increasing the installed wind and photovoltaic power generation capacity to over 1.2 billion kilowatts. Although the Russia-Ukraine conflict has increased the weight of security in the “Energy Trilemma” -- cleanness, affordability and security -- the potential of new energy for improving energy independence and security has attracted further attention. As Frans Timmermans, the EU climate policy chief, said in January, renewable energy is a feasible way to ensure energy security and affordability.

IV. What are the implications for China’s low-carbon energy transition?

Both the global energy supply crisis in 2021 and the Russia-Ukraine conflict this year are calling for systematic thinking to address climate change and the energy transition. China may consider how to take advantage of domestic and international situations and policy opportunities to maintain its own energy security and high-quality development from the following aspects:

First, accelerating investment in the construction of a new energy system mainly based on renewable energy, especially a new electricity system, is a multi-purpose step to stabilize growth, enhance energy security, improve air quality and mitigate climate change. China shall speed up the pilot application and promotion of the generation-grid-load-storage-utilization integrated energy system mainly based on renewable energy in different regions; study and address the challenges faced by the pilots of wind-photovoltaic-hydro--storage integrated energy system such as consumption only within provinces but hindered delivery to the outside, insufficient coordinated development of regional power grids, poor price transmission mechanism, etc.; explore energy storage cost allocation mode, and implement mechanisms that provide economic incentives to regulate peaks and valleys in electricity usage through strengthening demand response; step up large-scale development of wind and solar energy resources and the construction of large-scale bases, promote the optimized development of distributed wind and photovoltaic power in the central, eastern and southern regions, and propel the development and construction of offshore wind power in the east China; orienting to wind and solar power grid parity, formulate policies to further reduce the financing cost of renewable energy enterprises and give greater support to renewable energy development in terms of land allocation, prioritized queuing for IPO, targeted lending and RRR cut; in particular, prioritize renewable energy projects in the 2022 investment plan for growth maintenance.

Second, guiding the orderly withdrawal of the coal-fired power under the background of decarbonization and energy security. The role of coal-fired power in power system should be changed from the existing base-load energy to regulating energy. On the basis of eliminating outdated production capacity, China shall renovate existing coal-fired power plants to provide flexible peak regulating services, enlarge the consumption space of clean energy during the period of new energy development, and ensure that most coal-fired power plants will be decommissioned smoothly after a more reasonable period of operation (20 or 30 years); formulate fiscal and monetary policies and mechanisms conducive to coal withdrawal, and strictly control the risk of stranded assets caused by coal-related projects. In short, the stock must be stabilized while the increase has to be strictly controlled.

Third, strengthening China’s competitive advantage in the manufacturing of new energy equipment. As the world’s largest manufacturer of new energy equipment components, China occupies 6 and 8 of the world’s top 10 wind power and photovoltaic module manufacturers respectively. New energy installation targets in the global market cannot be achieved without Chinese enterprises. In 2021, China’s photovoltaic module output totaled 182GW, with over 50% (about 98GW) exported overseas, among which Europe as the largest importer accounted for 40%. The EU expects to double wind and photovoltaic installed capacity by 2025 and triple by 2030, meaning 480 gigawatts of wind turbines and 420 gigawatts of photovoltaic capacity will be added by 2030, the largest increase globally so far. Due to the small scale and high cost of the European photovoltaic industry chain, Europe depends on imports from China for most of the components, and the corresponding Chinese new energy manufacturers will see a surge in demand. Facing this opportunity, China shall maintain and constantly improve the competitiveness of new energy equipment manufacturing and shape long-term competitive advantages.

Fourth, speeding up the electrification of vehicles and maintaining a stable supply chain. When setting targets for electrification of vehicles, China shall start from a higher level taking into account the advancement of carbon neutrality goals in Europe and the U.S. and the greater efforts they have made in reducing transport industry’s emissions, which will lead to American and European car companies moving faster in terms of electrification than Chinese counterparts that have overtaken them through shortcuts but will lose the existing competitive advantages in the near and medium term. So setting targets that are roughly in line with or even faster than the U.S. and European targets for electrification of the transport sector will contribute to the different policy objectives of economic growth, energy security, air quality and climate action. Although the energy crisis caused by the Russia-Ukraine conflict will accelerate the electrification process of the global transport industry to a certain extent, the prices of upstream raw materials continue to soar (lithium carbonate, the key battery material, has increased tenfold in the past year), and China’s new energy vehicle companies have started the second round of price raise in 2022. In order to cope with the high cost of raw materials, China shall extend the industrial chain (e.g. automobile companies and battery manufacturers deploy joint ventures upstream) while strengthening battery recycling which is an optimal choice to ensure stable supply and prices.

Fifth, guiding overseas green investment and strengthening low-carbon technology cooperation and trade with other countries. China shall raise environmental standards for exports to European and American countries and provide financial support for low-carbon products exported to developing countries; make climate and energy cooperation a positive factor in easing geopolitical tensions, further leverage China’s leading role in global climate action, and contribute to the transformation of global energy security.